Weekly Market Update

Closings on existing homes rebounded in October. And while we saw a pullback in new construction last month, home builders are feeling more positive about the future. Here are the top stories:

Existing Home Sales Beat Estimates

Home Builders Feeling Optimistic About the Future

New Construction Eased in October

Continuing Jobless Claims Top 1.9 Million

Latest LEI Suggests “Challenges” Ahead

Existing Home Sales Beat Estimates

Existing Home Sales, which reflect closings on existing homes, rebounded in October, up 3.4% from September and 2.9% from a year ago. This was the first annual increase in more than three years. The rise in closings last month makes sense, as the data likely reflects people who were shopping for homes in August and September when rates had moved lower.

What’s the bottom line? October’s improvement in Existing Home Sales may be a blip because of the subsequent rise in rates this fall. And while inventory also increased to 1.37 million units available for sale (+0.7% MoM and +19.1% YoY), it’s important to note that many homes counted in existing inventory are under contract and not truly available for purchase. In fact, there were only 954,000 “active listings” at the end of last month, so inventory is tighter than the reporting implies.

Regarding demand, homes remained on the market for an average of 29 days in October, while 19% of homes sold above list price, showing that there are still bidding wars in about one-fifth of sales nationwide. Plus, competition is expected to rise when rates move lower. All in all, the pent-up demand for homes combined with ongoing tight supply continues to bode well for housing as an investment and continued home price appreciation over time.

Home Builders Feeling Optimistic About the Future

Home builder sentiment rose for the third straight month, per the National Association of Home Builders (NAHB), who reported that their Housing Market Index increased three points to 46 in November. Any score over 50 on this index, which runs from 0 to 100, signals that more builders view conditions as good than poor.

What’s the bottom line? While confidence remains below 50 in contraction territory, there was improvement in all three index components (buyer traffic, current and future sales expectations). Plus, future sales expectations jumped 7 points to 64, moving well above 50 into expansion territory.

NAHB Chair, Carl Harris, confirmed that “builders anticipate an improved regulatory environment in 2025.”

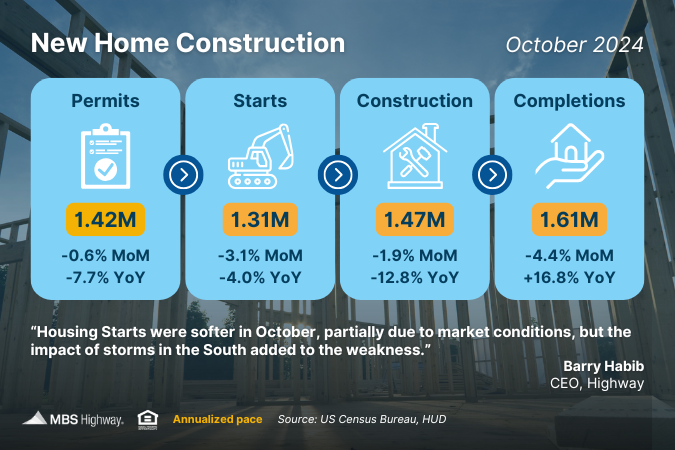

New Construction Eased in October

Even though home builder sentiment has started rising, builders pulled back on new construction last month, with Housing Starts falling 3.1% from September. Starts for single-family homes, which make up the bulk of homebuilding and are the most crucial due to buyer demand, were down nearly 7%.

Building Permits, which reflect future construction, moved lower overall though Single-family Permits inched 0.5% higher.

What’s the bottom line? While higher mortgage rates slowed production in October, the impact of the hurricanes in the South also added to the weakness seen in construction activity last month.

In broader terms, new home building is still not keeping up with demand as Housing Starts are near six-year lows. The limited new supply on the market relative to household growth should continue to support home prices.

Continuing Jobless Claims Top 1.9 Million

Initial Jobless Claims hit their lowest level since April, as 213,000 people filed for unemployment benefits for the first time. This reflects a decline of 6,000 from the previous week.

However, continuing claims were a different story, as they surged by 36,000 to top 1.9 million for the first time in three years.

What’s the bottom line? While new unemployment filings were at seven-month lows, the elevated number of Continuing Jobless Claims shows that it’s taking longer for people to find jobs.

And with many people only receiving benefits for 26 weeks, the fact that Continuing Claims are rising as people’s benefits are expiring also suggests weakness and a slower pace of hiring.

Latest LEI Suggests “Challenges” Ahead

The Conference Board released their latest Leading Economic Index (LEI), which takes a broad look at the economy and tracks where it’s heading in the near term. October brought a 0.4% drop, which followed September’s 0.3% decline. The biggest negative contributor last month was the weak manufacturing sector.

What’s the bottom line? The LEI has trended negative in recent years, with Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, noting that “apart from possible temporary impacts of hurricanes, the US LEI continued to suggest challenges to economic activity ahead.”

What to Look for This Week

There’s a cornucopia of reports ahead of the Thanksgiving holiday. In housing news, we’ll see appreciation data and October’s New Home Sales on Tuesday. Pending Home Sales follow on Wednesday. Tuesday also brings the minutes from the Fed’s latest meeting. On Wednesday, look for the second reading on third quarter GDP, the latest Jobless Claims and the Fed’s favored inflation measure, Personal Consumption Expenditures.

Technical Picture

Mortgage Bonds continue to trade in a wide range between overhead resistance at the 200-day Moving Average and support at 100.43. The 10-year ended last week trading sideways in the middle of a range with support at 4.33% and a ceiling at 4.50%.